Austin car title loans offer quick cash by using vehicle equity, ideal for those with poor credit or urgent needs. To choose a legitimate lender, check reviews, licensing, and transparent terms. Verify trustworthiness through licensing, compare rates and terms, and review online customer ratings.

Navigating the world of Austin car title loans can be daunting, but understanding your options is key. This article guides you through the process of selecting a trusted lender in Austin, Texas. We break down the intricacies of Austin car title loans, highlighting crucial factors like interest rates, repayment terms, and customer reviews. By following the detailed steps provided, you’ll gain the confidence to make an informed decision and secure the loan that best suits your needs.

- Understanding Austin Car Title Loans

- Key Factors to Consider When Choosing a Lender

- Steps to Verify a Trusted Lender in Austin

Understanding Austin Car Title Loans

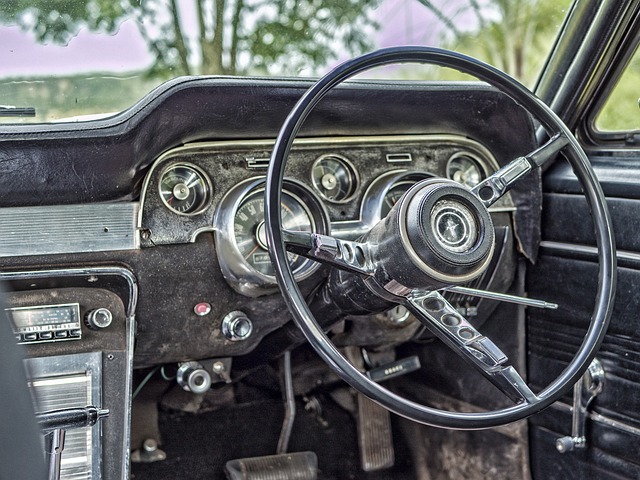

In Austin, understanding Austin car title loans is paramount when seeking quick financial solutions. These loans utilize the equity in your vehicle, allowing owners to access fast cash without traditional banking routes. The process involves pledging your car’s title as collateral, offering a simple and swift alternative to bank loans or credit cards. This method is particularly appealing for those with less-than-perfect credit or urgent financial needs.

With options like Austin car title loans, even semi truck owners in San Antonio can explore similar financing opportunities. Unlike conventional loans that depend on extensive documentation and credit checks, these loans provide a faster turnaround time, making them ideal for unexpected expenses or short-term financial gaps. The convenience and accessibility of Austin car title loans have made them increasingly popular among residents seeking immediate financial aid without the usual delays.

Key Factors to Consider When Choosing a Lender

When choosing a lender for Austin car title loans, there are several key factors to consider. Firstly, verify their legitimacy and reputation. Reputable lenders will have clear terms and conditions, transparent interest rates, and positive customer reviews. Check if they’re licensed and regulated by the state of Texas to ensure compliance with local laws.

Secondly, assess the overall process. A reliable lender should offer an easy and convenient online application for Austin car title loans. They must also provide clear information about the vehicle ownership requirements, making it hassle-free for you to understand and meet these criteria. The title loan process should be straightforward, with quick turnaround times and minimal paperwork, ensuring a stress-free experience.

Steps to Verify a Trusted Lender in Austin

Verifying a trusted lender for Austin car title loans involves a few crucial steps. Start by checking the lender’s licensing and registration with the Texas State Banking Department. Ensure they have a valid and active license to operate as a car title loan provider in the state of Texas. This step is essential to safeguard against fraudulent activities and ensure you’re dealing with a legitimate business.

Next, research their interest rates and repayment terms. Compare them across multiple lenders to get an idea of competitive rates. Remember that while low-interest rates are attractive, it’s equally important to consider the loan payoff period. A lender that offers reasonable interest rates and allows you to keep your vehicle during the loan period might be a better choice in the long run. Check online reviews from previous customers to gauge their satisfaction levels and identify any red flags or consistent issues reported against the lender.

When considering an Austin car title loan, it’s essential to choose a trusted lender to ensure a secure and fair transaction. By understanding the key factors and following the steps outlined in this article—such as checking reviews, verifying licenses, comparing rates, and assessing customer service—you can make an informed decision. Remember, a reputable lender prioritizes your well-being, offering transparent terms and conditions tailored to your needs. So, take control of your financial situation with confidence by selecting a trusted provider of Austin car title loans.