Austin car title loans, though popular for quick cash, come with high-interest rates and risks of debt cycles. With minimal documentation required, these loans can trap borrowers in a cycle of rollovers and increasing fees. Safer alternatives like flexible payment plans or title transfer can help Austin residents avoid these pitfalls.

In Austin, where the vibrant economy masks hidden financial pitfalls, understanding the risks of Austin car title loans is paramount. These short-term loans, secured by your vehicle’s title, may seem like a quick fix for unexpected expenses. However, the high-interest rates and potential for loan rollovers can trap borrowers in a cycle of debt. This article explores the dangers of rollovers, their impact on Austin residents, and safer alternatives to navigate financial challenges without falling into this risky trap.

- Understanding Austin Car Title Loans: A Brief Overview

- Risks Associated with Loan Rollovers: The Austin Perspective

- Alternatives to Title Loan Rollover: Safer Options for Austin Residents

Understanding Austin Car Title Loans: A Brief Overview

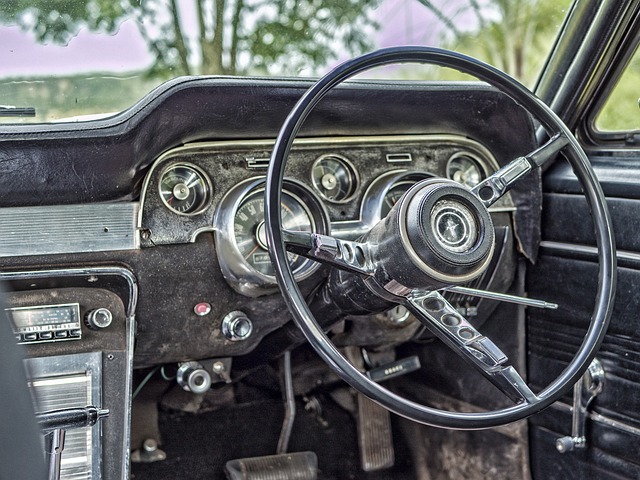

In Austin, car title loans have emerged as a popular option for individuals seeking quick cash. This type of loan is secured by the borrower’s vehicle equity, allowing lenders to offer fast approval and funding. Here’s how it typically works: borrowers provide their vehicle’s title to the lender as collateral, and upon approval, they receive a cash advance against the vehicle’s value. It’s important to note that Austin car title loans are designed for short-term financial relief, but they can be risky if not managed carefully.

While these loans offer accessibility and convenience, especially for those with limited credit options, they come with high-interest rates and potential fees. The borrowing process is straightforward, often requiring only a few documents and minimal credit checks. However, this ease of access might lead to a cycle of debt where borrowers continuously rollover the loan due to their inability to repay the full amount on time. This practice can result in significant financial strain, particularly when considering the already high-interest rates associated with Austin car title loans compared to traditional cash advances or Houston title loans.

Risks Associated with Loan Rollovers: The Austin Perspective

In Austin, where the market is saturated with various loan options, including Austin car title loans and title pawn services, it’s crucial to understand the risks associated with loan rollover practices. These quick-fix financial solutions, often enticingly presented, come with hidden dangers that can trap individuals in a cycle of debt. The initial appeal of rolling over an existing loan to cover immediate expenses is tempting, but the consequences can be significant.

When considering Austin car title loans or any form of refinancing, borrowers should be aware that these practices may result in higher interest rates and fees. Over time, this can lead to a substantial increase in the overall loan amount. Furthermore, the pressure to repay these short-term loans within strict timelines can cause financial strain, impacting individuals’ ability to manage other essential expenses and long-term financial goals. Loan payoff strategies require careful planning, and borrowers should explore alternatives that offer more sustainable financial solutions rather than falling into the trap of continuous rollovers.

Alternatives to Title Loan Rollover: Safer Options for Austin Residents

Instead of opting for a title loan rollover, Austin residents have several safer alternatives to consider when facing financial constraints. One option is to explore car title loans that offer flexible payment plans. These plans can make it easier to manage debt over time compared to the quick fix of a rollover, which often extends the original loan and increases interest charges.

Another viable solution involves title transfer. This process involves selling your vehicle for a fair market price, allowing you to avoid the high-interest rates associated with title loans. A title transfer can provide a substantial lump sum or monthly payments, depending on your needs, while also freeing up your asset from the loan. By considering these alternatives to Austin car title loans rollovers, residents can protect their financial well-being and steer clear of the potential pitfalls of high-interest debt cycles.

Austin car title loans, while offering quick cash solutions, can lead to a cycle of debt if rollovers are relied upon. This article has highlighted the risks and consequences of loan rollover in the Austin market, emphasizing the need for caution. Alternatively, exploring safer options like credit unions or savings accounts can help residents avoid these pitfalls. By understanding the potential dangers, individuals can make informed decisions regarding their financial well-being and steer clear of the high-interest trap associated with title loan rollovers.